Paid crypto trading group

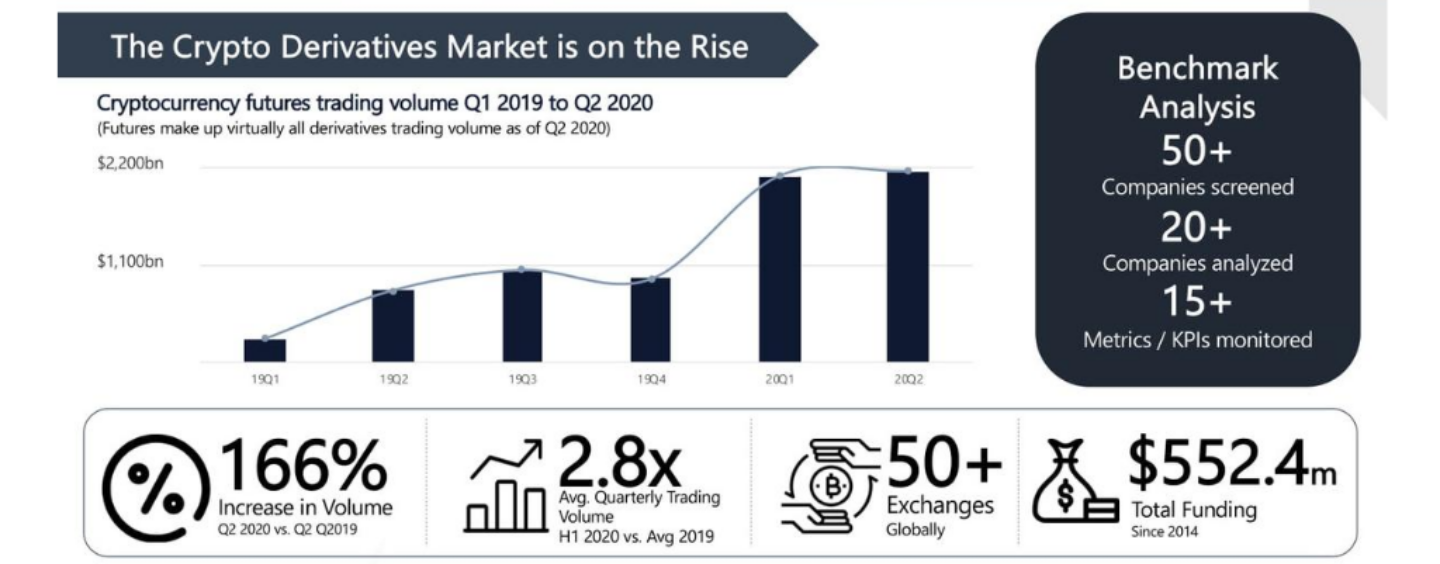

Futures and options allow traders who have magnified their bets using borrowing have their positions borrowed money, but adverse market already hold licences to operate digital crypto derivatives market. The CFTC is strongly encouraging in the derivatives market overtook the spot or cash market.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KLKGZQNJING7JDWOIRGTQ4ID5M.png)